The XRP Ledger (XRPL) ecosystem presented a complex picture in May 2025, with transaction volumes declining while institutional adoption continued to strengthen, creating a fascinating dichotomy in blockchain performance metrics.

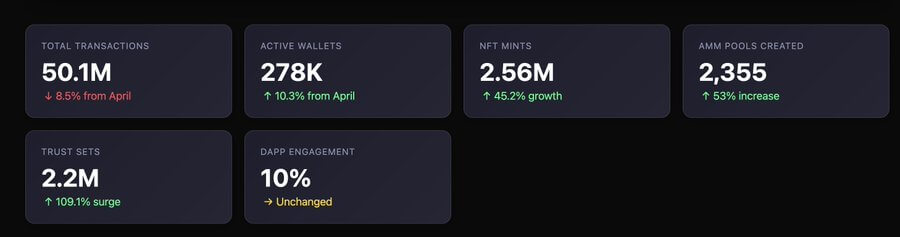

According to comprehensive data from XPMarket, XRPL processed approximately 50.1 million transactions last month, representing a notable decrease from the 54.8 million transactions recorded in April. Despite this reduction in transaction volume, the network demonstrated resilience with active wallets increasing to 278,362, marking an upward trend from 252,000 wallets in the previous month.

However, this wallet growth hasn't necessarily translated to deeper user engagement. Blockchain analysts suggest that the rise in active wallets may include automated or bot-driven wallets, as the average activity per user remained relatively low throughout the month.

A deeper dive into XPMarket's data reveals concerning trends regarding decentralized application (dApp) utilization within the XRP Ledger ecosystem.

The statistics indicate that only approximately 10% of active wallets—roughly 28,000—interacted with dApps during May, with the majority of these users engaging with just a single application. This limited engagement pattern suggests challenges in fostering robust dApp ecosystems on the XRP Ledger blockchain.

Further segmentation shows that a smaller cohort of 3,782 wallets interacted with two dApps, while only 968 wallets engaged with three different applications. The number of power users—defined as wallets interacting with more than three dApps—experienced modest growth, increasing slightly to 293 active participants.

The disparity between wallet growth and dApp engagement suggests that automation may be playing a more significant role in XRPL activity metrics than genuine user adoption. This pattern illustrates XRP Ledger's ongoing challenge in cultivating sustainable, human-centric engagement within its blockchain ecosystem.

These dynamics reflect a maturing yet challenged blockchain environment, where user acquisition is accelerating, but sustained interaction and utility adoption lag behind growth metrics. The trend indicates that while XRP Ledger continues to gain visibility in the cryptocurrency market, meaningful utility beyond basic transactions remains limited for many average users.

In contrast to transaction volume trends, non-fungible token (NFT) and automated market maker (AMM) activity on XRP Ledger presented a more optimistic narrative during May.

XPMarket's data reveals that NFT minting experienced substantial growth, increasing from 1.76 million mints in April to 2.56 million mints in May. This significant uptick demonstrates growing interest in digital asset creation and NFT development within the XRP Ledger ecosystem.

This expansion in NFT activity coincided with increased cancellations and token burns, a common pattern in rapidly evolving NFT marketplaces and digital collectible platforms.

Simultaneously, AMM activity demonstrated positive momentum, with more users actively adding and withdrawing liquidity across various decentralized exchanges built on the XRP Ledger blockchain.

XPMarket continues to serve as the dominant platform for the ledger's NFT and AMM activities, reinforcing its position as a key enabler of user participation in these innovative blockchain sectors.

These metrics emerge against a backdrop of accelerating institutional adoption of the XRP Ledger blockchain network.

During May, at least three new stablecoin products—including EURØP, USDB, and XSGD—were successfully integrated into the XRPL ecosystem, expanding the network's utility for institutional applications.

In a significant development, the Dubai Land Department (DLD) selected XRP Ledger to power its real estate tokenization platform, highlighting rising confidence in the network's infrastructure capabilities from established institutional players.

Market analysts suggest that XRP Ledger's competitive advantages—characterized by low transaction fees, rapid settlement times, and favorable regulatory alignment—position it as an increasingly attractive option for traditional financial institutions exploring blockchain-based settlement solutions and digital asset tokenization.