CryptoSlate spoke exclusively with Ethan Vera, the CFO of Luxor Mining and a former investment banker at Goldman Sachs, where he was part of the firm's dedicated blockchain team.

We delved into a wide range of critical topics, including the pervasive issue of Bitcoin mining centralization, the impact of money printing on the cryptocurrency market, and why the widely-feared BTC mining "death spiral" failed to materialize after the halving. We also explored how Luxor, alongside their latest project, Hashrate Index, is striving to bring greater transparency and efficiency to the crypto mining sector.

Ethan Vera, CFO of Luxor Mining: My concerns about centralization are definitely at the entity level, not the geographic level.

A lot of people are afraid of the headline number that 65% of the world's hash rate is produced in China. I don't believe that's the primary concern. It's a function of the supply chain—China excels at producing mining hardware, has access to cheap energy, and maintains miner-friendly regulations. The probability of a coordinated, state-level attack is extremely low. However, the concentration of hash rate power among a few entities is what worries me.

There are three entities—Bitmain, Poolin, and f2pool—that control over 50% of the network's total hashrate. If three individuals with sufficient computing power colluded, they could launch a 51% attack. If executed during off-peak hours, they could potentially reorganize the blockchain and execute double-spends. Some argue they could only disrupt the network, but the core value of Bitcoin is its stability. Even a single successful double-spend event would be a significant concern.

I believe the concentration of hashrate power in any single region is a risk, whether it's in the U.S. or Canada. Ideally, we should aim for a landscape where no single country controls more than 30% of the network at the entity level. That would be the safest outcome.

It's unclear how certain governments might fight against Bitcoin. If a nation wanted to promote its central bank digital currency (CBDC), it might attempt to attack Bitcoin through a double-spend to crash its price and diminish its long-term value.

Ethan: In Venezuela, the situation is complex. There are miners using their operations to escape a devaluing national currency. That's a powerful use case that helps circumvent capital controls. However, governments with strict capital controls are trying to clamp down, seizing mining farms where possible.

The same is true for Iran. The government wants to avoid capital flight from its citizens, but the state itself wants to use Bitcoin to evade sanctions. Using state-sponsored Bitcoin mining is an effective way to circumvent sanctions, similar to how North Korea has utilized Monero mining.

I'm not concerned because each of these jurisdictions only contributes a few percentage points of the total hash rate. This situation actually highlights the need for nations to support their local mining industries. As Bitcoin becomes increasingly valuable, mining is becoming a natural national security priority. This will put pressure on countries like Russia and the U.S. to be more supportive of their domestic miners.

Ethan: I don't think that holds true right now. I believe the price of Bitcoin is driven primarily by sentiment and supply/demand dynamics, which miners are reactive to, not proactive with. Hashrate follows price, not the other way around. Miners might be forced to sell their Bitcoin holdings during periods when their margins are squeezed, which can have some impact on price.

Overall, miners are more reactive to the Bitcoin price than drivers of it. Therefore, the idea of the cost of production being a price floor for Bitcoin doesn't make much sense. If the Bitcoin price drops due to excess supply, we'll simply see a corresponding drop in hash rate, and the cost of production will adjust downward as well.

Ethan: Certainly. In the most extreme scenario, a death spiral would occur after block 1 of the post-halving difficulty adjustment period. That's when there are 2,015 blocks remaining until the next difficulty retarget. In that worst case, if Bitcoin's price crashed even further, miners would be less incentivized to mine because they're being paid less subsidy. If the block reward is cut in half while the price is simultaneously down significantly, that's a double whammy for miner revenue. Even then, there will always be low-cost, efficient miners who remain operational and would eventually guide the network to its difficulty adjustment.

In general, I believe the difficulty adjustment mechanism will do its job, preventing a true death spiral. We might see periods of longer block times, but there will never be a time when no blocks are being found. There will always be miners who are profitable enough to continue.

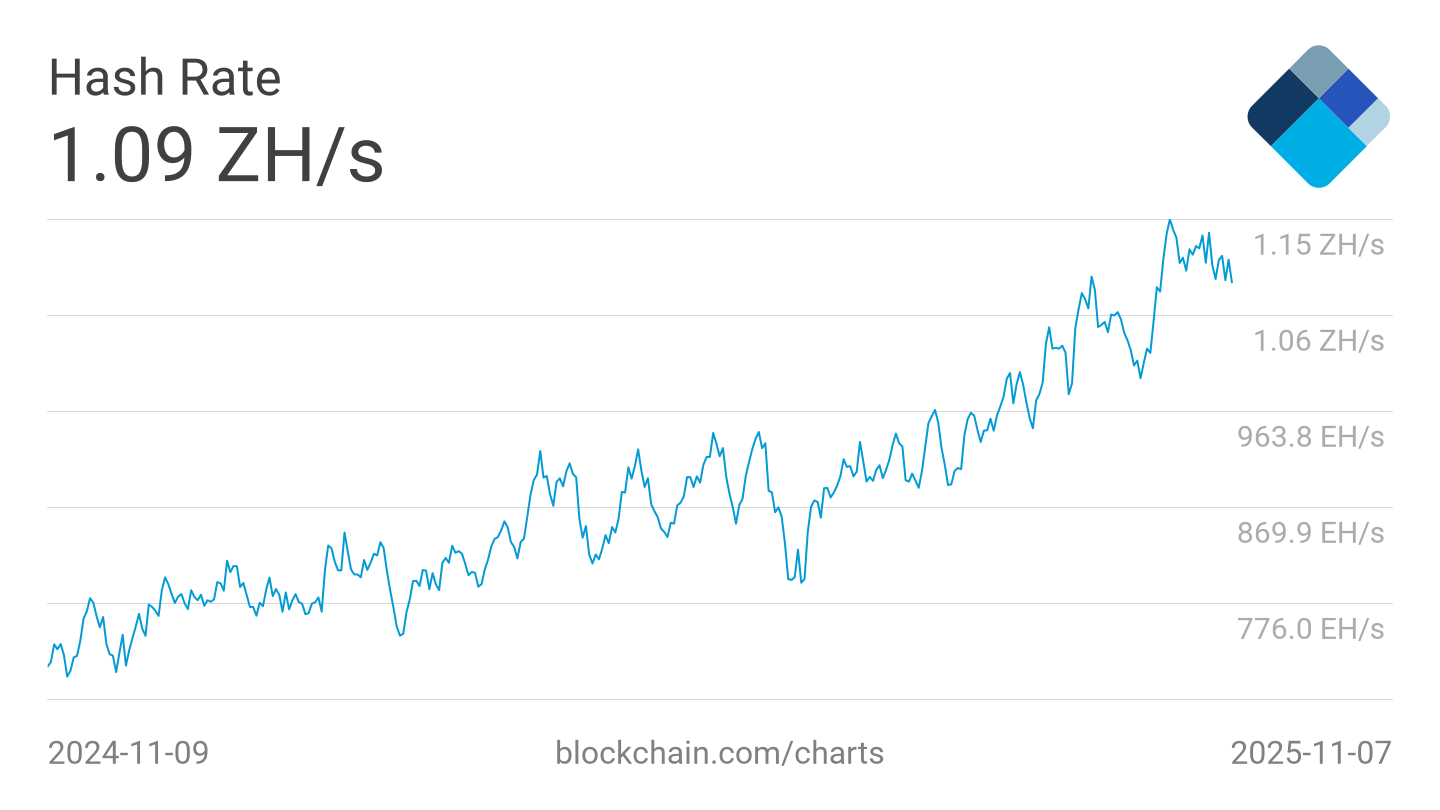

With the last halving, it didn't happen—we saw a temporary 25-30% drop in the hash rate at most. And that drop was from miners who were less efficient. There were still ~100 exahashes/second remaining on the network.

It might happen for smaller altcoins, but for Bitcoin, I don't believe a true death spiral will ever occur.

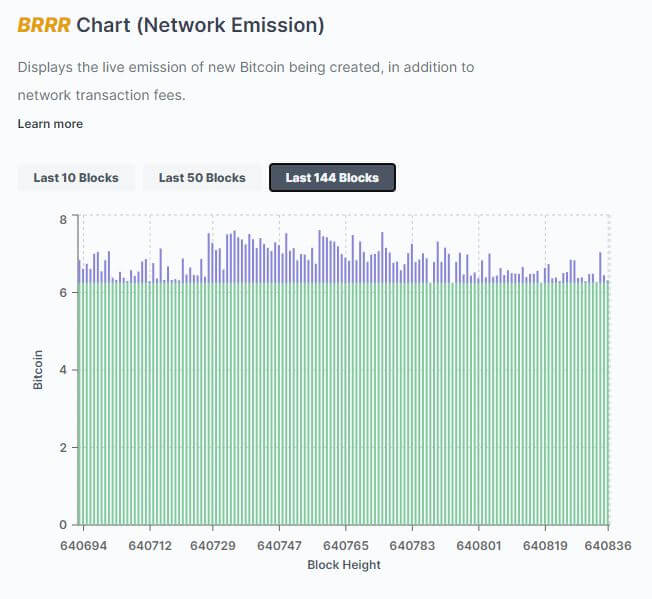

Ethan: It's a double-edged sword because miners directly benefit from higher transaction fees, but users obviously want lower fees. As we move into an era of progressively lower block subsidies, fees become increasingly critical for miner security and revenue.

In some ways, having high transaction fees relative to the block subsidy is beneficial, as it strongly incentivizes miners to secure the Bitcoin network. I don't necessarily see higher tx fees as a negative for the ecosystem. I know I'm a bit biased since I benefit from them, but I believe it's a net positive for Bitcoin because it makes the proof-of-work security model robust.

In the long term, we're seeing new financial products emerge, like a transaction fee futures market where you can trade the future price of fees. Miners can hedge against fee volatility, while exchanges and service providers, who are hurt by high fees, can take the other side of that trade. That's an incredibly exciting market to watch develop.

Ethan: I believe it will be one of the keys. I am a firm believer that the 2008 financial crisis was a catalyst in making Bitcoin popular. Many of the people you see in the Bitcoin space today are ex-bankers and ex-finance professionals. I think that period of time turned them onto Bitcoin and proved its use case as an alternative.

If we move into another period of heavy money printing and QE, that same message will resonate with a new wave of people entering the space. We haven't seen a major price event driven by this yet. But from a long-term perspective, this is incredibly bullish for Bitcoin. In an era of quantitative easing and easy money, it makes perfect sense to have programmable money where the supply is known and predictable in advance.

Ethan: Before mining, I was in finance in asset management, public equities, and then cross-border M&A between China and the U.S. That's where I got exposure to the broader crypto industry, both working on ICO projects and on the blockchain team at Goldman Sachs.

Then we started Luxor about two and a half years ago. It began as a Sia mining pool, then expanded into a variety of other coins. We're currently focused on hashrate marketplaces and how you can trade that compute power. We're building a spot market for hash rate where sellers can sell their hash rate to a diverse set of buyers. In the long term, we're trying to build sophisticated trading tools for hashrate, such as futures, where miners can hedge their operational risk by locking in a percentage of their revenue, and investors can gain exposure to an attractive alternative asset class.

Ethan: Hashrate Index was created because the mining industry is so opaque. When making an investment, you have to figure out which machines to buy, how the machines are priced, potential shipping delays, and future difficulty changes. Then, once you plug the machines in, you have to deal with firmware and selling your hashrate to a pool. The process is non-transparent and a black box—you don't always know if they're withholding hashrate from you.

The entire value chain of mining is difficult and requires a high degree of trust. This holds back many investors from entering the industry. Hashrate Index was born from our internal need to bring more transparency to help investors and miners. We do this by publishing transparent ASIC machine prices, the value of hash rate, and a variety of other important metrics.

This interview has been condensed and edited for clarity.