In a bold move that coincides with rising inflation and Bitcoin's unprecedented surge, Coinbase has launched two compelling television advertisements across the United States, reigniting cryptocurrency's populist appeal at a critical economic juncture.

One advertisement reimagines Bitcoin as "money from the future," while another presents a striking economic narrative: the cost of an average American home has dramatically decreased from 30,000 BTC to merely 5 BTC in just over a decade. This marketing strategy combines cinematic production values with incisive economic commentary, perfectly calibrated to capture the current zeitgeist.

This innovative advertising campaign shifts focus from celebrity endorsements to authoritative narration, pairing atmospheric drone cinematography with data-driven storytelling that resonates with contemporary audiences.

In "Money From the Future," the narrator begins with a sweeping panorama of America's industrial renaissance, featuring fighter jets, advanced robotics, and bustling construction sites, before posing a thought-provoking question: "Who's upgrading the most fundamental technology of all—our money system?"

The advertisement confidently declares: "It's crypto. If you want to build the future, it starts with money from the future."

The second advertisement, "Bitcoin House," delivers an even more direct comparison: In 2012, purchasing a median-priced home in the United States would have required 30,000 BTC. A decade later, that figure stood at 20 BTC. Today, it's shockingly low at just five BTC. The campaign culminates with a provocative question designed to spark reflection: "If home prices keep falling when measured in Bitcoin, why do they continue rising in US dollars?"

This message carries particular weight in May 2025, as the Consumer Price Index (CPI) shows persistent upward pressure, and Bitcoin has just surpassed the $100,000 milestone. The Federal Reserve's monetary policies have once again become a focal point of political discourse, with Coinbase notably avoiding criticism of the central banking system.

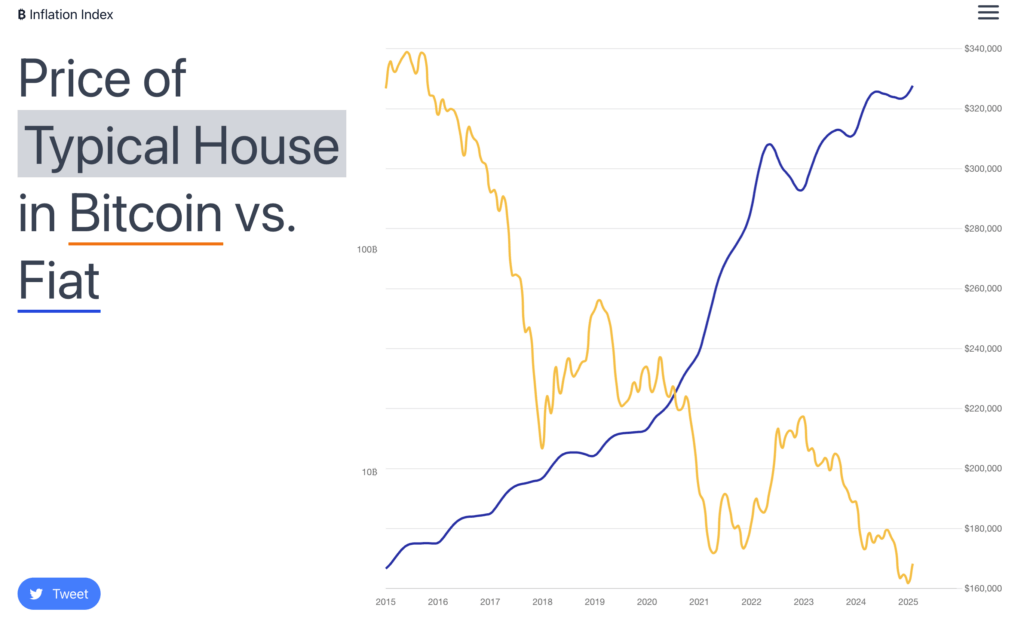

In response to its own promotional tweet, Coinbase directed viewers to an interactive website comparing average US housing prices with Bitcoin valuations. The visualization presents a stark contrast: while traditional home prices have climbed from $170,000 in 2015 to over $320,000 in 2025, the equivalent Bitcoin amount has decreased from more than 500 BTC to fewer than 3 BTC.

These figures reveal a remarkable economic truth: when valued in Bitcoin, the cost of a typical American home has experienced a 99% decline since 2015, while simultaneously increasing by 94% when measured in US dollars.

This advertising initiative represents a component of Coinbase's comprehensive strategy to shape public perception and understanding of cryptocurrency. The exchange continues to spearhead a global advocacy initiative titled "Stand With Crypto," which aims to encourage legislators to establish clear regulatory frameworks for digital assets. The initiative now includes customized content tailored for four key geographic markets: Canada, the United States, the United Kingdom, and Australia.

Legislative discussions surrounding cryptocurrency regulation are gaining momentum. In Washington, the White House maintains its Crypto Roundtable series, while the president continues personal investments in cryptocurrency ventures, including the Official Trump memecoin and World Liberty Financial.

Coinbase's advertising campaign arrives at a pivotal moment, reminding both viewers and policymakers that cryptocurrency represents a lasting technological and financial evolution. The digital currency ecosystem is becoming more comprehensible, resilient, and integrated with the economic concerns that matter most to American citizens.

As America embraces a renewed focus on construction and development, Coinbase is strategically positioning cryptocurrency not as a peripheral investment, but as an essential foundation for economic progress. These innovative advertisements transform Bitcoin's image from that of a speculative asset into a monetary system upgrade designed for our AI-powered, technologically advanced future. This represents a calculated investment in narrative development, impeccably timed to coincide with a new market cycle.