World Liberty Financial (WLFI), a decentralized finance (DeFi) venture associated with former US President Donald Trump, has successfully obtained a $7.5 million USDT loan through the leading Aave decentralized lending platform, marking a significant milestone for the crypto project.

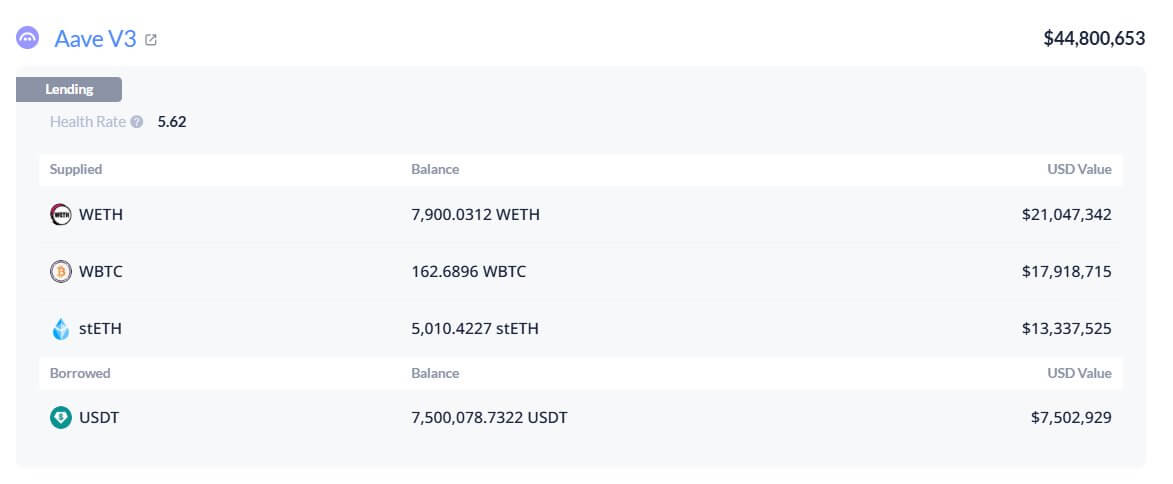

According to blockchain analytics firm Onchain Lens, which reported the transaction on June 10, WLFI supplied crypto assets valued at over $52 million to Aave as collateral. This substantial collateral included 7,900 Ethereum (ETH) tokens worth approximately $21 million, 162.69 Wrapped Bitcoin (WBTC), and 5,010 staked Ethereum (stETH) valued at $13.31 million.

Following this substantial collateral deposit, WLFI proceeded to borrow $7.5 million worth of USDT from Aave V3 and subsequently transferred the borrowed funds to a BitGo wallet for secure storage.

While WLFI has not yet issued an official statement regarding the loan or its precise objectives, market analysts speculate about the potential motivations behind this strategic DeFi maneuver.

Onchain Lens suggested that the primary purpose of the loan might be to facilitate USD1 withdrawals. USD1 represents WLFI's newly launched stablecoin, which maintains a 1:1 peg with the US dollar. Since its introduction, the digital asset has gained considerable traction across both centralized and decentralized trading platforms, including securing a listing on Binance, one of the world's largest cryptocurrency exchanges.

This financial move by WLFI reflects a broader industry trend within the cryptocurrency ecosystem. In recent months, numerous prominent organizations, including the Ethereum Foundation, have increasingly utilized DeFi lending platforms to access stablecoin liquidity without the need to liquidate their core cryptocurrency holdings.

The recent $7.5 million loan transaction underscores the deepening strategic relationship between WLFI and Aave, currently the largest decentralized lending protocol in the decentralized finance landscape.

Looking back, WLFI had announced last year its ambitious plans to deploy a customized instance of the Aave V3 money market specifically on the Ethereum blockchain. This initiative aims to enable borrowing and lending activities for key digital assets including ETH, WBTC, USDT, and USDC.

As part of this collaborative launch, WLFI committed to sharing 20% of generated protocol fees with AaveDAO in exchange for utilizing the DeFi platform's advanced code infrastructure. Furthermore, AaveDAO will receive an allocation of 7% of WLFI's total token supply, which grants the decentralized autonomous organization governance rights and participation in WLFI's expanding ecosystem.

Concurrently, the Trump-associated DeFi project demonstrated its confidence in Aave's ecosystem by making a strategic investment exceeding $1 million in AAVE tokens alongside other promising DeFi-related projects.

Industry observers and crypto analysts interpret these strategic moves as clear indicators of WLFI's strong commitment to further integrating with Aave's robust DeFi infrastructure and contributing to the growth of decentralized finance.