The cryptocurrency market experienced significant volatility this week as Bitcoin briefly dipped to the $100,000 mark before recovering to $103,000, following a high-profile political dispute between U.S. President Donald Trump and tech mogul Elon Musk. This market turbulence resulted in approximately $873 million in Bitcoin long liquidations, highlighting the growing influence of political events on cryptocurrency valuations.

The public confrontation, which unfolded across social media platforms Truth Social and X, began with Trump's threat to revoke federal contracts and subsidies from Musk's companies. Musk responded by criticizing Trump's fiscal policies, escalating tensions that had been building for weeks. On June 3, Musk had already condemned Trump's domestic spending bill as a "disgusting abomination" on X, marking a significant shift in their previously aligned political stance.

This political discord triggered a cross-asset selloff that erased $150 billion from Tesla's market capitalization and contributed to the widespread liquidations in the cryptocurrency market. The situation underscores how political developments in traditional markets can create ripple effects throughout the digital asset ecosystem.

The relationship between Trump and Musk deteriorated rapidly from strategic alliance to public feud. Trump took to Truth Social to vow "to terminate Elon's Governmental Subsidies and Contracts" and labeled Musk "crazy." In response, Musk claimed that Trump's 2024 election victory depended on his support and called for the president's impeachment, suggesting JD Vance as a replacement.

Trump dismissed Musk's influence as having "worn thin," a stark contrast to their once-close partnership that had begun during the 2024 campaign and continued through Musk's tenure leading the Department of Government Efficiency (DOGE). This alliance had previously been viewed favorably by cryptocurrency enthusiasts who anticipated pro-crypto regulatory policies.

The conflict escalated into personal territory when Musk accused Trump of betraying key campaign promises and stated, "Time to drop the really big bomb: @realDonaldTrump is in the Epstein Files. That is the real reason they have not been made public... the truth will come out." Although Musk provided no evidence for these claims, the remarks accelerated the unraveling of their professional relationship, with Trump publicly acknowledging, "I don't know if we will [have a relationship] anymore."

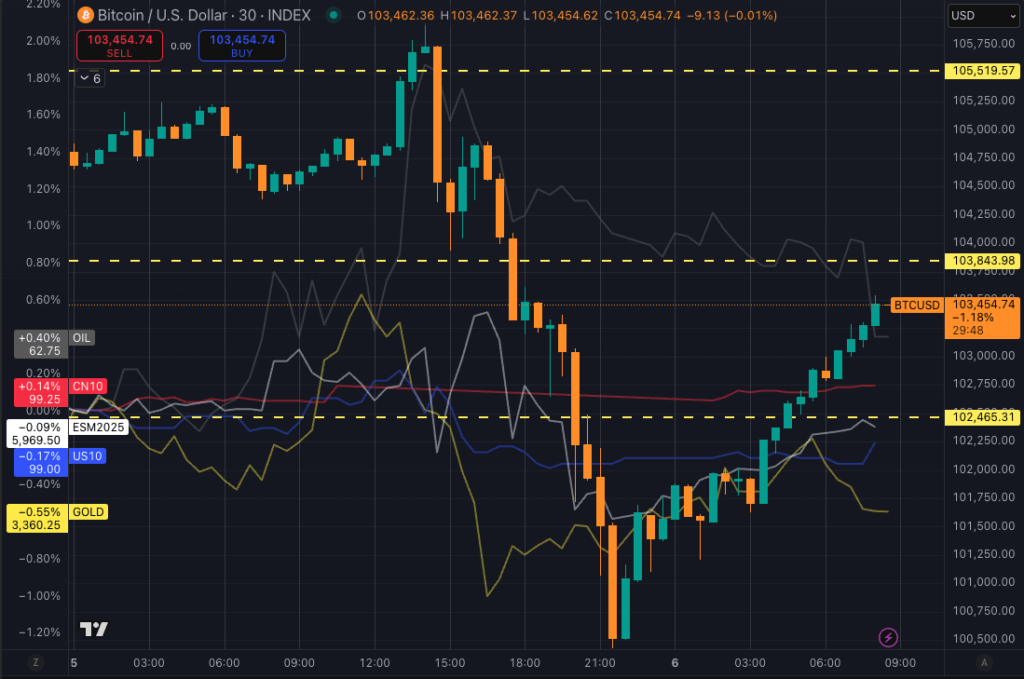

The market reacted swiftly to this political turmoil. By 22:00 GMT on June 5, Bitcoin had fallen to $100,400 before recovering above $103,000 in early morning trading. Tesla's stock plunged 14%, reflecting market concerns over Trump's explicit threats to the company's government-related revenue streams. SpaceX, which holds substantial NASA contracts, also emerged as a potential target in this political dispute, though no immediate contract terminations have been confirmed.

Market analysts remain divided on whether Trump's remarks will translate into formal action against Musk's enterprises or remain primarily rhetorical. Musk's declaration that he might decommission SpaceX's Dragon program added further uncertainty to the situation, though operational continuity clauses in NASA agreements suggest such drastic measures would require prolonged negotiations.

Bitcoin's sharp decline followed by rapid recovery demonstrates investor sensitivity to political volatility at six-digit valuation levels. According to data from CoinGlass, $873 million in long positions were liquidated within hours of the news, though no systemic stress has been recorded on blockchain networks.

Key blockchain metrics, including hash rate and exchange reserves, remain stable, suggesting that the selloff was sentiment-driven rather than based on fundamental factors in the cryptocurrency ecosystem. CryptoSlate data indicates that while the drawdown reached 4.8% overnight, the psychological $100,000 level attracted significant dip-buying interest, reinforcing its perception as a crucial support level despite thin liquidity conditions.

The broader cryptocurrency market now faces an uncertain regulatory landscape. Once a vocal advocate for cryptocurrency deregulation and Bitcoin adoption at the federal level, Musk now finds himself outside Trump's sphere of influence. This departure creates ambiguity regarding how Trump's administration will approach cryptocurrency policy for the remainder of 2025.

As CryptoSlate has reported, Trump's shift toward targeted economic retaliation represents a notable evolution in the administration's stance toward the technology sector. This development raises questions among traders about whether political personalities now pose greater volatility risks to cryptocurrency markets than traditional macroeconomic indicators or halving cycles.

While Musk has warned that Trump's tariff expansions will trigger a U.S. recession in the second half of 2025, market participants are focusing on whether Bitcoin can maintain its six-digit valuation under such unpredictable political conditions. The recent price action suggests that cryptocurrency markets remain highly susceptible to political developments, particularly those involving influential tech leaders and political figures.