The Ethereum Foundation (EF) has strategically entered the decentralized finance (DeFi) landscape by securing a $2 million loan in GHO stablecoins through the Aave protocol. This innovative approach utilizes wrapped Ethereum (wETH) as collateral, demonstrating the Foundation's evolving treasury management strategy in the cryptocurrency sector.

Marc Zeller, founder of the Aavechan Initiative, brought attention to this development on May 29, highlighting how the Foundation's utilization of GHO perfectly aligns with Aave's core value proposition. This strategic move enables ETH holders to maintain their positions while accessing much-needed liquidity—a fundamental advantage of DeFi protocols.

As Zeller noted, "The Ethereum Foundation's participation in Aave's ecosystem represents a significant validation of our protocol's utility for major stakeholders."

Stani Kulechov, founder of Aave Protocol, reinforced this perspective, emphasizing that the EF's strategy of supplying ETH and simultaneously borrowing on Aave exemplifies the complete utility cycle that DeFi offers to participants. This approach allows organizations to leverage their digital assets without liquidating core holdings.

While the Ethereum Foundation has not officially commented on the transaction as of this reporting, the broader cryptocurrency community has widely endorsed this strategy as a prudent approach to treasury management and long-term sustainability in the volatile crypto market.

Maksym Blazhkun, co-founder of WeNode, commented on the significance of this move, stating that institutional adoption of DeFi lending protocols signals growing confidence in the sector's maturity and reliability.

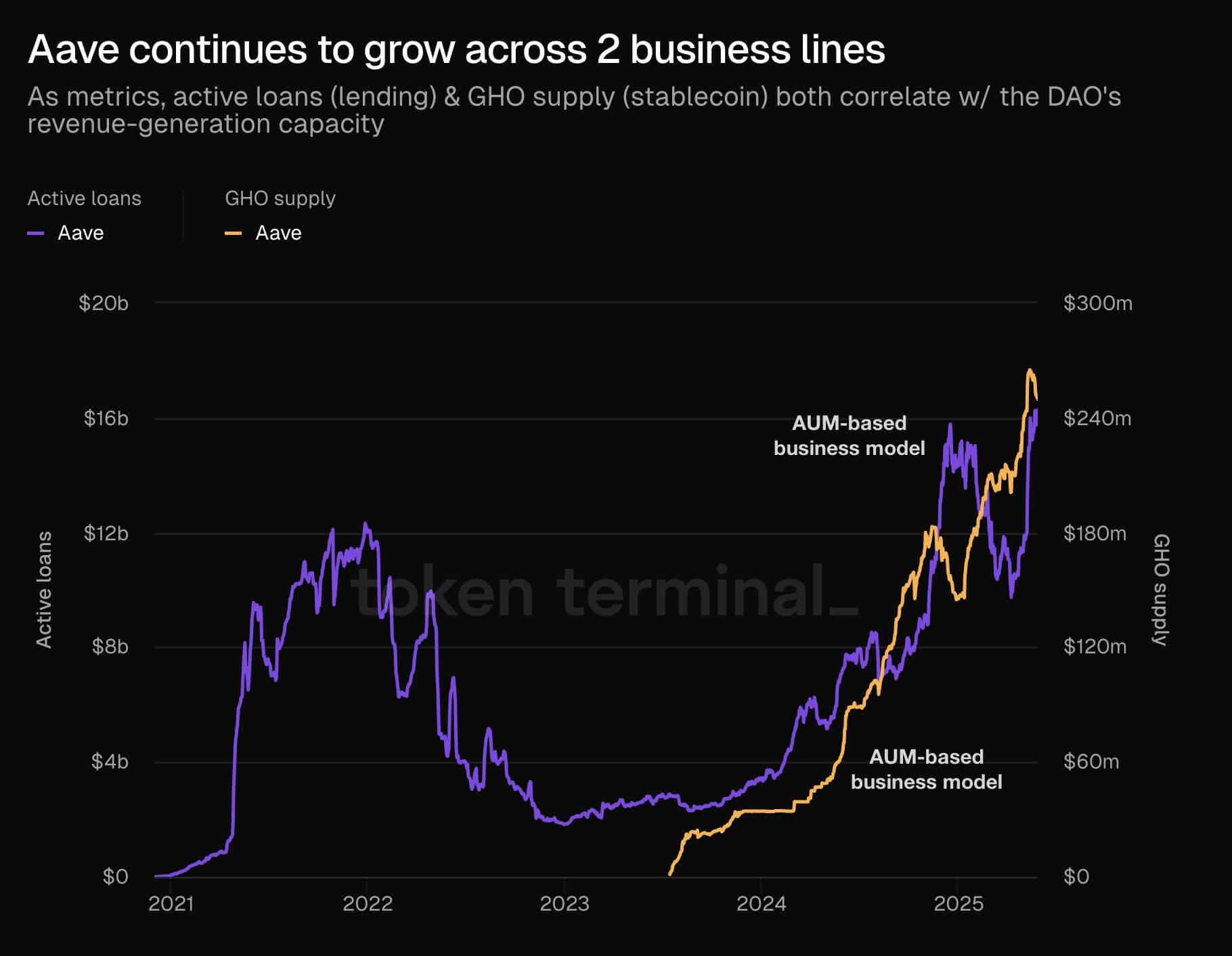

According to DeFiLlama data, Aave maintains its position as Ethereum's leading DeFi lending protocol, with total value locked (TVL) exceeding $43 billion. GHO, Aave's native overcollateralized stablecoin, currently boasts a circulating supply of $249 million, further establishing the protocol's significance in the decentralized finance ecosystem.

Blockchain analytics firm Token Terminal has identified active lending and GHO issuance as critical metrics directly correlating with Aave DAO's revenue generation capabilities, underscoring the strategic importance of the Ethereum Foundation's participation.

This borrowing initiative follows recent strategic pivots by the EF to reshape its treasury approach, addressing community feedback regarding asset management. Earlier this year, the Foundation deployed 50,000 ETH across multiple DeFi platforms, including a significant February allocation of 30,800 ETH into Aave's core market and Aave Prime. Additional strategic deployments included 10,000 ETH to MakerDAO's Spark and 4,200 ETH to Compound.

The current borrowing strategy marks a significant strategic evolution away from liquidating ETH to fund operations. Instead, the EF is now harnessing DeFi lending mechanisms to preserve its ETH holdings while simultaneously generating yield through these innovative financial instruments.

This approach also represents a notable departure from the criticism the Foundation encountered in January when it executed the sale of 300 ETH valued at approximately $1 million, highlighting a more sophisticated understanding of market dynamics and stakeholder expectations.