Tether Chief Technology Officer, Paolo Ardoino, recently revealed that the stablecoin giant was well-prepared for a bank run scenario. Ardoino explained that the Tether team has conducted extensive stress tests, simulating a 2008-style market crash. They concluded that the company's reserves are robust enough to honor all USDT redemption requests, even amid a similar systemic crisis.

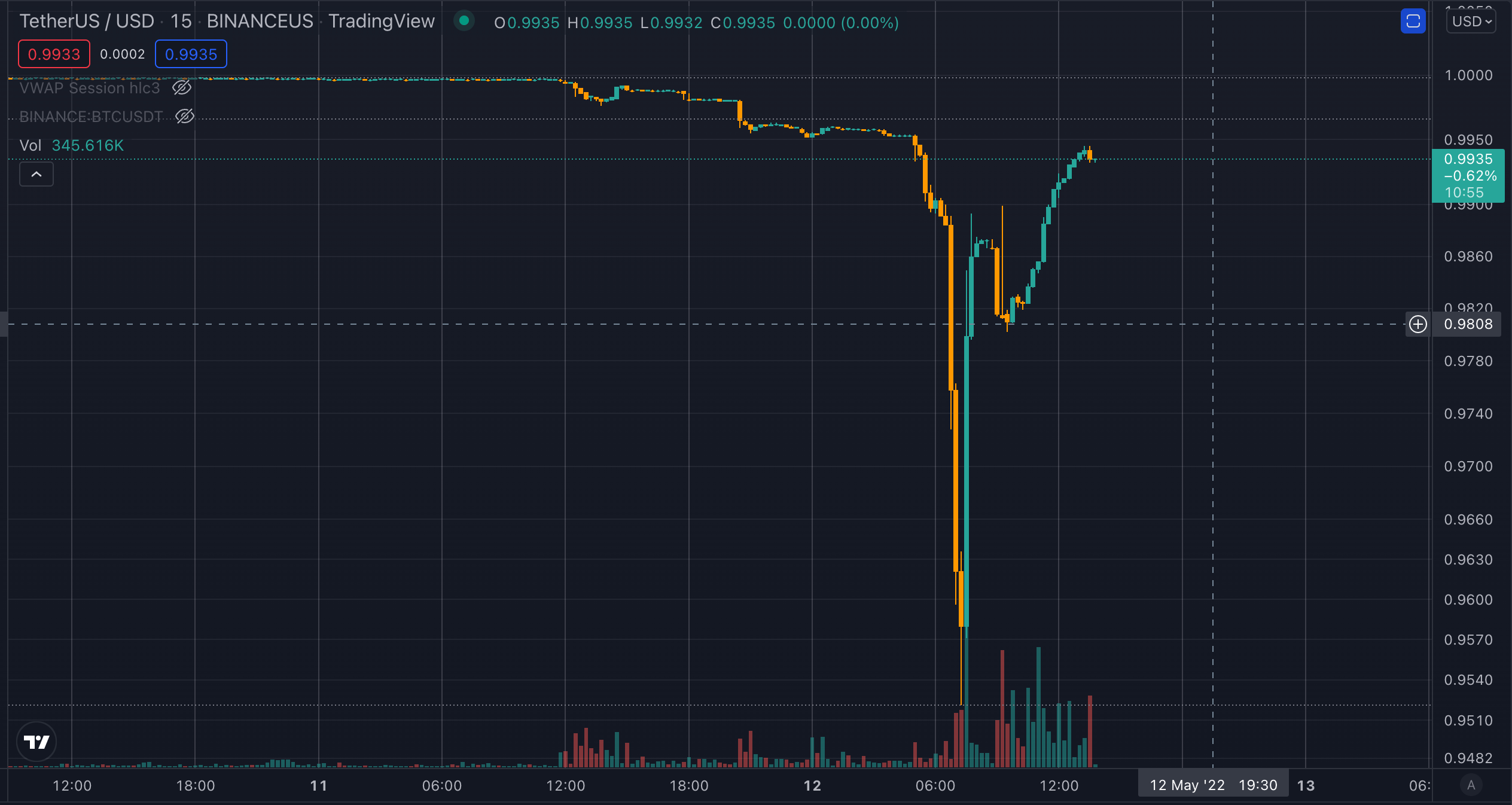

Yesterday, Tether's (USDT) peg to the U.S. dollar was severely tested, dipping to $0.95 on major exchanges like Binance.US and Coinbase. This marked the first time the stablecoin fell below the critical $0.995 level since 2020. It has since recovered to approximately $0.993, sparking speculation that the peg may soon be restored. Intriguingly, Tether might view this 5% deviation and a 48-hour recovery as a successful stress test of its system. However, the potential for this level of volatility could now be factored into the broader crypto market, where a stablecoin's ability to swing 5% will undoubtedly be scrutinized.

Regarding the current market conditions, Ardoino tweeted, "Reminder that Tether is honoring USDt redemptions at 1$." In our discussion, Ardoino asserted that Tether has never refused a redemption. However, it appears that investors require a minimum of $100,000 in USDT to use their direct redemption portal and must be outside the U.S. unless they qualify as a Sophisticated Investor. Tether announced it has serviced over $300 million in USDT redemptions in the last 24 hours alone.

When asked whether Tether will forever remain pegged to the dollar, Ardoino commented:

“We take into account the worst moments in the history of finance… when we have to simulate what a bank run situation would look like on a Tether portfolio.”

Expanding on the conversation, he stated that if we encounter hyperinflation and a "taxi ride costs $1 million," it would also be "1 million USDT." The discussion touched upon rising global inflation and the theoretical demise of fiat currency. Yet today, it is stablecoins that are in the news cycle, with fears that they could be wiped out amid the volatile market conditions.

Check the full interview here for more insight into how Tether prepared for a bank run (apologies for the audio quality due to a technical issue):

In response to a direct request for comments, Tether issued the following statement regarding the current market conditions;

Tether is pleased to confirm that it is operating as usual amid some expected market panic following this week’s market movements.

Tether continues to process redemptions normally, with verified customers (in allowed jurisdictions) able to redeem USDt on Tether.to for USD$1. In the last 24 hours alone, Tether has processed over 300m USDt redemptions and is already processing more than 2bn today, without issue.

Tether has maintained its stability through black swan events and highly volatile market conditions and even in its darkest days Tether has never once failed to honor a redemption request from any of its verified customers. Tether will continue to do so which has always been its practice.

Tether is the most liquid stablecoin in the market, backed by a conservative and robust portfolio that consists of cash & cash equivalents, such as short-term Treasury Bills, money market funds, and commercial paper holdings from A-2 and above rated issuers. The value of Tether’s reserves is published daily and updated once per month. You can find the most current information here: https://tether.to/en/transparency.