The cryptocurrency landscape is witnessing a significant shift as businesses increasingly consider Bitcoin treasury strategies. Changpeng Zhao, the visionary behind Binance and prominent figure in the digital asset space, has issued an important cautionary note for corporations exploring this financial frontier. As more organizations evaluate Bitcoin as a corporate treasury asset, Zhao emphasizes the critical need for comprehensive risk assessment before committing company resources to the world's leading cryptocurrency.

Through his social media channels on June 3, the former Binance CEO highlighted that while embracing Bitcoin treasury solutions presents exciting opportunities, prudent financial management requires acknowledging the inherent volatility of digital assets. Zhao's insights come at a pivotal moment as corporate Bitcoin adoption accelerates across various industries.

Financial experts note that the decision to incorporate Bitcoin into corporate balance sheets represents more than just an investment strategy—it signifies a fundamental rethinking of how companies approach treasury management in an increasingly digital economy.

The cryptocurrency industry pioneer emphasized that complete avoidance of Bitcoin treasury allocation carries its own set of potential consequences, including missed opportunities for portfolio diversification and vulnerability to traditional financial system instabilities. This balanced perspective offers valuable guidance for treasurers navigating the complex decision of digital asset integration.

When considering Bitcoin treasury implementation, Zhao suggests that organizations should view digital assets not as speculative instruments but as strategic components of a diversified treasury strategy, provided proper risk mitigation frameworks are established.

Addressing concerns about extreme market conditions, the crypto exchange founder outlined scenarios that corporate treasuries should consider, including potential market crashes or even the theoretical possibility of Bitcoin losing all value. While such outcomes remain highly improbable according to many analysts, Zhao's perspective underscores the importance of comprehensive contingency planning for any Bitcoin treasury strategy.

Financial advisors specializing in digital asset treasury management agree that establishing clear parameters for Bitcoin treasury allocation—including percentage of total assets, rebalancing thresholds, and exit strategies—provides essential guardrails for organizations navigating this emerging asset class.

The timing of Zhao's warnings coincides with an unprecedented surge in corporate Bitcoin treasury adoption, with organizations across various sectors reevaluing their approach to digital assets as inflationary pressures and economic uncertainties persist.

Current statistics from Bitcoin Treasuries tracking platforms reveal that more than 200 corporations have now established Bitcoin treasury holdings, with high-profile entrants including Trump Media and GameStop recently announcing their strategic positions in the digital asset. This expanding roster demonstrates the growing mainstream acceptance of cryptocurrency treasury management as a legitimate financial strategy.

Analysis from market intelligence firm Hodl15Capital indicates that the top 100 institutional Bitcoin treasury holders collectively command over 814,000 BTC, representing a significant portion of the cryptocurrency's circulating supply. Among these major players, Strategy (formerly known as MicroStrategy) maintains its position as the largest institutional holder with approximately 580,000 BTC in its corporate treasury, demonstrating the substantial commitment some organizations are making to digital asset diversification.

Industry analysts attribute this accelerating trend toward corporate Bitcoin treasury strategies to several converging factors, including evolving regulatory landscapes and shifting monetary policies. The growing sentiment that cryptocurrency provides a hedge against inflation has encouraged organizations to reconsider traditional treasury approaches in favor of digital asset allocations.

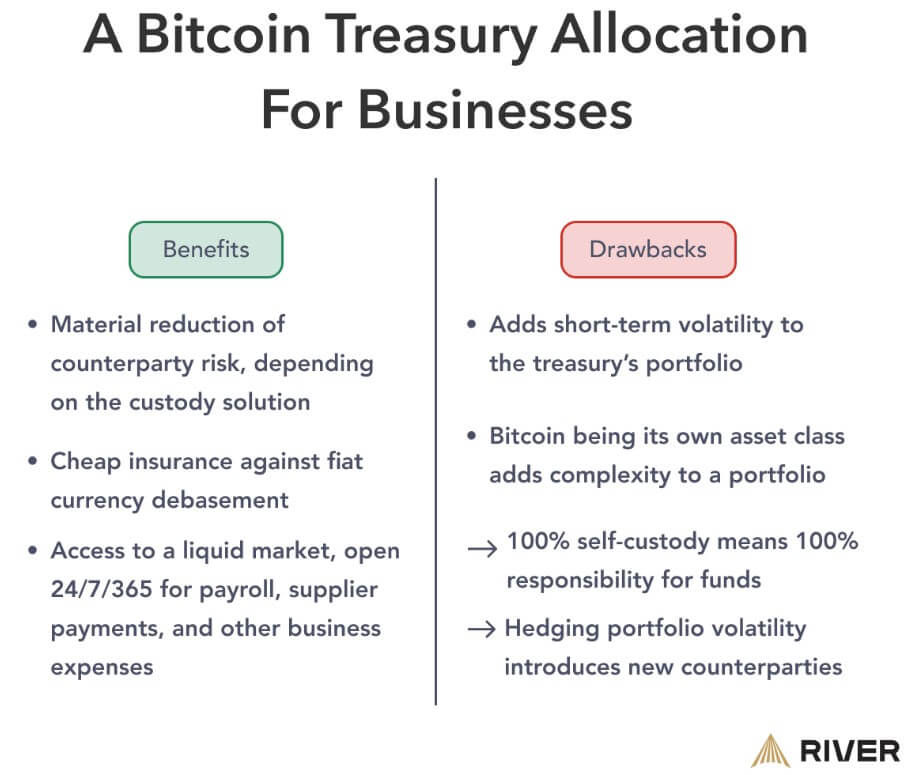

According to financial experts at River, a specialized cryptocurrency financial services provider, organizations implementing Bitcoin treasury solutions can significantly reduce counterparty exposure through strategic custody arrangements. By utilizing self-custody solutions or selecting custodians with strict lending policies, companies can enhance the security and integrity of their digital asset holdings while maintaining operational flexibility.

For multinational enterprises navigating complex currency exposures, Bitcoin treasury management offers compelling advantages as a bridge asset for international operations. The cryptocurrency's borderless nature facilitates streamlined cross-border transactions, potentially reducing settlement times and associated costs while providing greater transparency in global financial operations.

During periods of economic uncertainty characterized by low interest rates or rising inflation, Bitcoin as a treasury asset demonstrates its potential as a store of value. The cryptocurrency's fixed supply schedule and decentralized nature provide a compelling alternative to traditional fiat currencies, which remain susceptible to monetary debasement and policy shifts. This fundamental characteristic has positioned digital treasury assets as an attractive component for organizations seeking to preserve purchasing power over the long term.