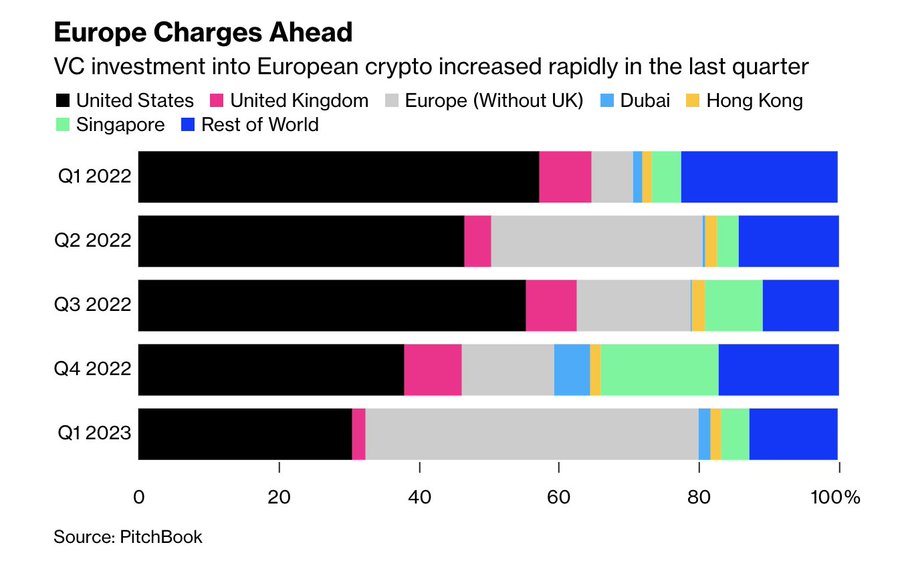

The European blockchain ecosystem has witnessed an extraordinary transformation in venture capital funding, with investments experiencing an unprecedented surge of nearly 800% between Q1 2022 and Q1 2023. This remarkable shift represents a pivotal moment for cryptocurrency innovation across the continent, with funding increasing from a modest 5.9% to an impressive 47.6% of total venture capital allocations.

Patrick Hansen, Director of Research and Policy at Circle, highlights that this exponential growth stems directly from the enhanced regulatory clarity following the European Union's implementation of the Markets in Crypto Assets (MiCA) legislation. This comprehensive regulatory framework has established Europe as a premier destination for blockchain entrepreneurs and investors seeking stability and clear guidelines.

While the European Parliament officially adopted the MiCA framework in April 2023, its comprehensive provisions will not be fully enforced until July 2024. Despite this timeline, the legislation has already generated substantial enthusiasm within the global crypto community. By establishing a unified regulatory approach across all 27 member states, MiCA effectively eliminates the fragmented compliance challenges that previously hindered blockchain innovation in Europe.

Although Europe's regulatory advancements have captured significant attention, the continent is not alone in creating favorable conditions for cryptocurrency businesses. Other jurisdictions, including the United Arab Emirates and Hong Kong, are actively cultivating environments that attract blockchain investment through progressive regulatory frameworks.

What unites these diverse regions is their commitment to providing clear, comprehensive regulatory guidelines for cryptocurrency enterprises operating within their borders. Hong Kong, for instance, has implemented new regulations specifically governing cryptocurrency exchanges that offer retail trading services, with enforcement commencing on June 1.

The emirates of Dubai and Abu Dhabi have similarly emerged as attractive destinations for blockchain enterprises, with major companies like Coinbase establishing significant operations. Brian Armstrong, Coinbase's CEO, recently praised the UAE's forward-thinking approach to cryptocurrency regulation. The exchange is actively pursuing licensing for virtual asset services, underscoring the region's appeal as a crypto-friendly jurisdiction.

In stark contrast to Europe and other progressive jurisdictions, the United States is experiencing an exodus of cryptocurrency businesses citing regulatory uncertainties. Throughout 2023, numerous firms including Nexo, Beaxy, and Bittrex have ceased operations primarily due to compliance challenges.

Even established exchanges like Coinbase and Gemini have responded to the challenging regulatory environment by establishing offshore operations and expanding their international presence. This strategic shift reflects a broader industry trend toward jurisdictions with more clearly defined regulatory pathways.

Major market makers Jane Street and Jump Crypto have also begun reducing their cryptocurrency exposure, citing regulatory concerns as a primary factor in their strategic decisions regarding blockchain venture capital allocation.