In a recent social media exchange between tech moguls Elon Musk and Michael Saylor, the conversation turned to investments—specifically whether Bitcoin represents a better opportunity than acquiring Manchester United Football Club. This debate raises an interesting question: how do these two assets compare as long-term investments?

The discussion began when Tesla and SpaceX CEO Elon Musk sparked market speculation by tweeting his interest in purchasing the crisis-hit Manchester United. MicroStrategy's Executive Chair Michael Saylor quickly responded, suggesting that the billionaire entrepreneur "would prefer that you buy some more Bitcoin" instead.

After initially creating a stir with his tweet, Musk later clarified that he has "no plans to buy any sports teams at this time." However, he couldn't resist mentioning that Manchester United was his childhood favorite team, leaving the door slightly ajar for future possibilities.

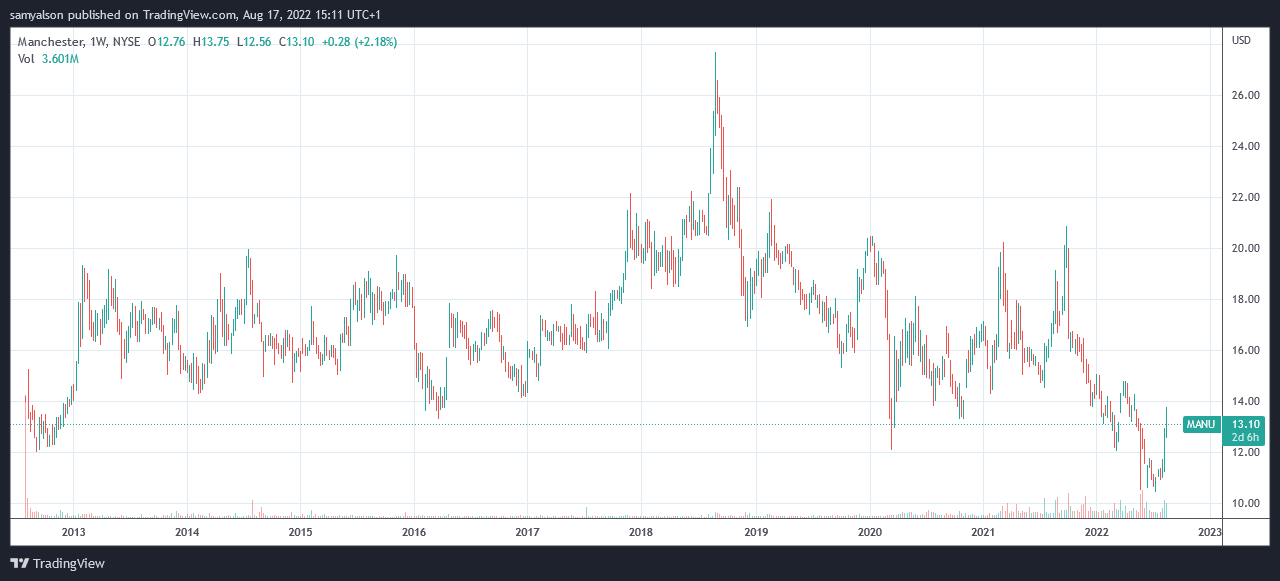

When Manchester United debuted on the New York Stock Exchange on August 10, 2012, with an initial offering price of $14 per share, Bitcoin was trading at just $11.39. At that time, few could have predicted the divergent paths these two assets would take.

Bitcoin reached its all-time high of $69,000 on November 11, 2021. As of this writing, the cryptocurrency is valued at $23,400. To put this performance in perspective, a $100 investment in Bitcoin on the day of Manchester United's IPO would have peaked at an astonishing $605,795—representing a remarkable 605,695% gain.

Even with the recent market downturn, Bitcoin investors who held through the volatility would still have unrealized gains of $205,443 on their initial $100 investment, equating to a 205,343% return.

In stark contrast to Bitcoin's meteoric rise, Manchester United stock (MANU) has shown relatively modest performance since its IPO. The club's shares reached an all-time high of $27.70 during the week of August 27, 2018.

Recent rumors of a potential hostile takeover, spearheaded by former board member Michael Knighton and backed by a consortium of investors, caused a temporary spike in the stock price. On August 17, MANU reached a 15-week high of $13.80.

An investor who purchased $100 worth of Manchester United shares at the time of the IPO would have seen their investment grow to $197.86 at the peak—a respectable but modest 98% gain. However, those who continued to hold would now be facing a $1.43 loss on their original investment, representing a -1.4% decline.

When comparing the peak performance of both assets, the difference is nothing short of extraordinary. Had an investor chosen Bitcoin over Manchester United stock in 2012, they would have been approximately 6,180 times better off financially.

This comparison highlights the potential of cryptocurrency investments versus traditional sports team ownership. While Manchester United faces numerous challenges both on and off the field, including a worst start to a Premier League season in seven years and ongoing protests from fans regarding ownership, Bitcoin has continued to demonstrate its resilience as a digital asset class.

The club's recent signings, including Lisandro Martínez from Ajax and Christian Eriksen from Tottenham, have yet to translate into on-field success. Meanwhile, the potential acquisition of Barcelona's Frenkie de Jong remains unresolved, adding to the uncertainty surrounding the club's future prospects.

On August 17, Knighton announced that he had failed to secure the necessary funding—estimated at approximately $4.25 billion—to proceed with his takeover bid, further clouding the club's financial future.

As the cryptocurrency market continues to mature and institutional adoption grows, the investment case for Bitcoin appears increasingly compelling when compared to traditional assets like sports team ownership, particularly when considering the long-term performance data.