The cryptocurrency landscape is currently witnessing a troubling phenomenon where blockchain networks are increasingly relying on memecoin trading activity to demonstrate their success. This approach creates a dangerous illusion of growth that masks fundamental weaknesses in these blockchain ecosystems.

Similar to how social media platforms once prioritized follower counts over meaningful engagement, many blockchains now celebrate memecoin transaction volumes while ignoring the lack of genuine utility or sustainable development. In Web2, sophisticated marketers understand that true success comes from conversion rates, active user engagement, and community-generated content—not superficial metrics.

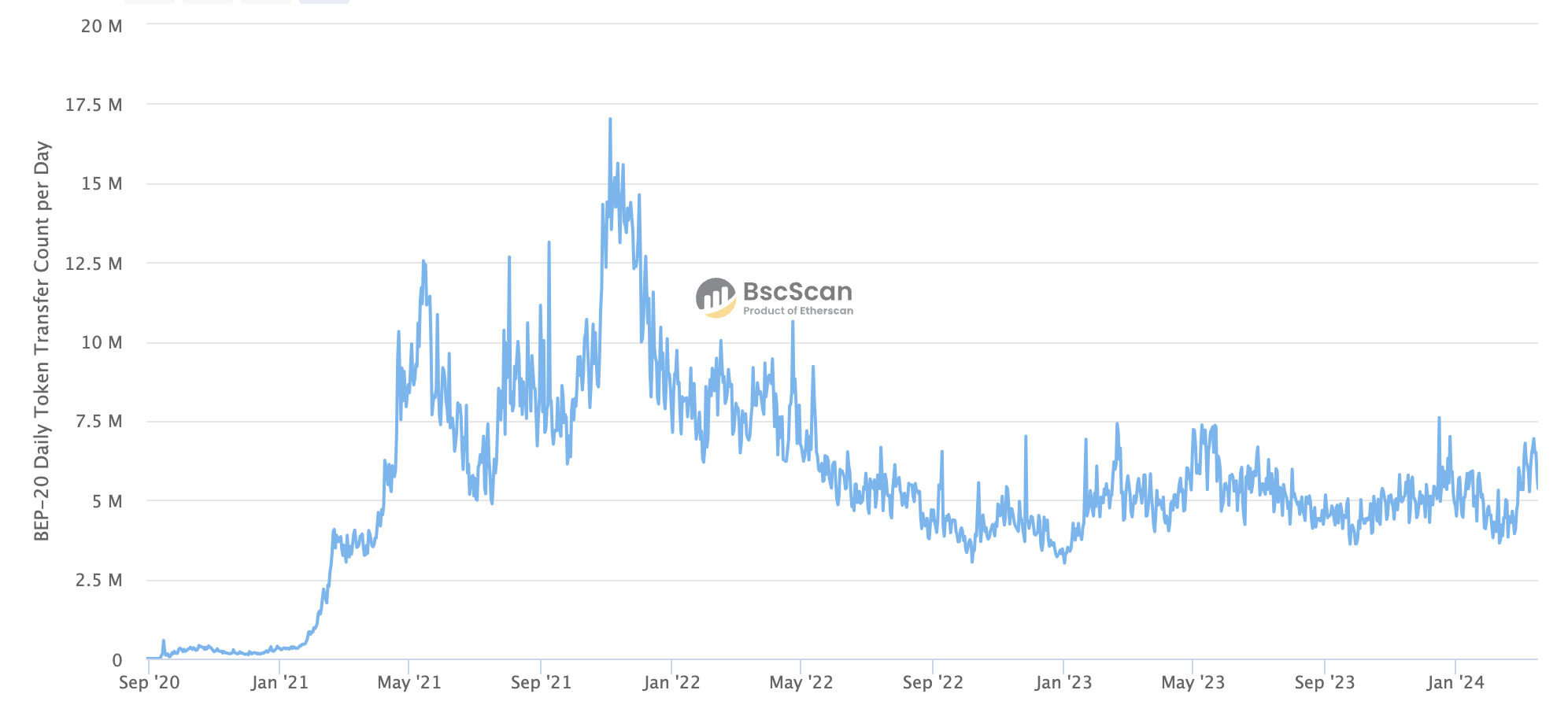

The BNB Chain serves as a cautionary tale. During the 2021 memecoin boom fueled by PancakeSwap trading activity, the network recorded approximately 17 million token transactions daily. This figure has since plummeted to around 5 million daily transactions—still an impressive number that tells an incomplete story.

Upon closer examination of BNB Chain's transaction data, we find that the majority of tokens being transferred are either memecoins or fraudulent scam tokens designed to exploit unsuspecting users. For instance, the USDT token with 1.2 million transfers in the past week isn't actually the official Tether token but rather a deceptive imitation.

Solana and Avalanche appear to be following BNB Chain's problematic trajectory. Solana's recent memecoin pre-sales have overshadowed its failed mobile phone launch, while Avalanche has been actively purchasing tokens for its treasury to inflate its 'community token' economy. These strategies may temporarily boost metrics but ultimately fail to create sustainable blockchain ecosystems.

While memecoins aren't inherently problematic, they should be recognized for what they are—speculative gambling assets rather than legitimate digital currencies. The current market environment has transformed many promising blockchain networks into digital casinos filled with worthless tokens and elaborate scams.

Participants in the memecoin market must understand they're essentially playing Russian roulette, with the primary goal being to avoid becoming exit liquidity for large holders.

As an early Dogecoin adopter from 2014, I witnessed firsthand how a memecoin could organically emerge from internet culture and serve as an introduction to cryptocurrency concepts. However, today's memecoin market bears little resemblance to that earlier era. Unlike Dogecoin's origins as a genuine cultural phenomenon, modern memecoins lack any utility beyond the hope that their value will increase.

Bitcoin content creator Layah Heilpern recently highlighted the dangerous narratives surrounding memecoins, noting how they create unrealistic expectations of financial transformation. In reality, most participants either enter positions too late or hold too long, becoming paper millionaires only temporarily without ever realizing actual profits.

CryptoQuant founder Ki Young Ju echoed these concerns, pointing to the case of Book of Meme (BOME), which achieved a $1 billion market cap despite minimal liquidity. Similarly, Slerf, a Solana pre-sale token, generated $700 billion in trading volume after its founder 'accidentally' burned all pre-sale tokens—demonstrating how artificial hype can create illusory success.

The most discussed memecoin recently, Dogwifhat (WIF), exemplifies how these tokens differ fundamentally from early memecoins like Dogecoin. Unlike Dogecoin which emerged organically from internet culture, modern memecoins are specifically designed to enrich early investors at the expense of retail participants.

Blockchain networks that emphasize memecoin trading while neglecting genuine innovation and utility would be more honest to simply acknowledge their true purpose:

As the saying goes, "I'm not mad, I'm just disappointed." As someone who holds Solana, BNB Chain, and Avalanche in my portfolio, this isn't an attempt to short these projects. Rather, it's an effort to bring clarity to the conversation about memecoins and expose the misleading narratives surrounding 'community' in the context of worthless tokens.

The only genuine memecoin community was Dogecoin, yet even its original developers eventually abandoned the project. It's time to recognize memecoins for what they are—speculative gambling assets—and implement appropriate warnings rather than pretending they represent blockchain innovation.