The cryptocurrency industry finds itself at a pivotal moment, facing financial contagion reminiscent of past crises. Just as toxic assets and derivatives triggered the 2008 global financial meltdown, the digital asset space now confronts its own challenges. The emergence of blockchain financial crisis scenarios has prompted significant debate about the role of bailouts in cryptocurrency markets.

Bitcoin has undeniably led a revolutionary movement of decentralized digital assets, once achieving a market capitalization exceeding $2.8 billion. While market conditions have since stabilized, the fundamental value proposition of digital currencies remains intact, with Bitcoin seeing remarkable adoption from legal tender status to potential inclusion in life insurance policies. Recent surveys indicate that most digital asset holders would welcome such innovative financial products.

Following Bitcoin's lead, Ethereum has cultivated a vibrant ecosystem of decentralized applications (dApps) through its versatile smart contract technology. This innovation formed the foundation for decentralized finance (DeFi), aiming to transform traditional financial processes. The dApp landscape spans diverse sectors including gaming, lending, and borrowing platforms, creating new opportunities for blockchain financial crisis solutions.

Despite the automated and decentralized nature of these Finance 2.0 platforms, financial contagion has still managed to infiltrate the system. The dramatic collapse of Terra (LUNA) served as a critical catalyst, sending shockwaves throughout the blockchain ecosystem that continue to resonate today.

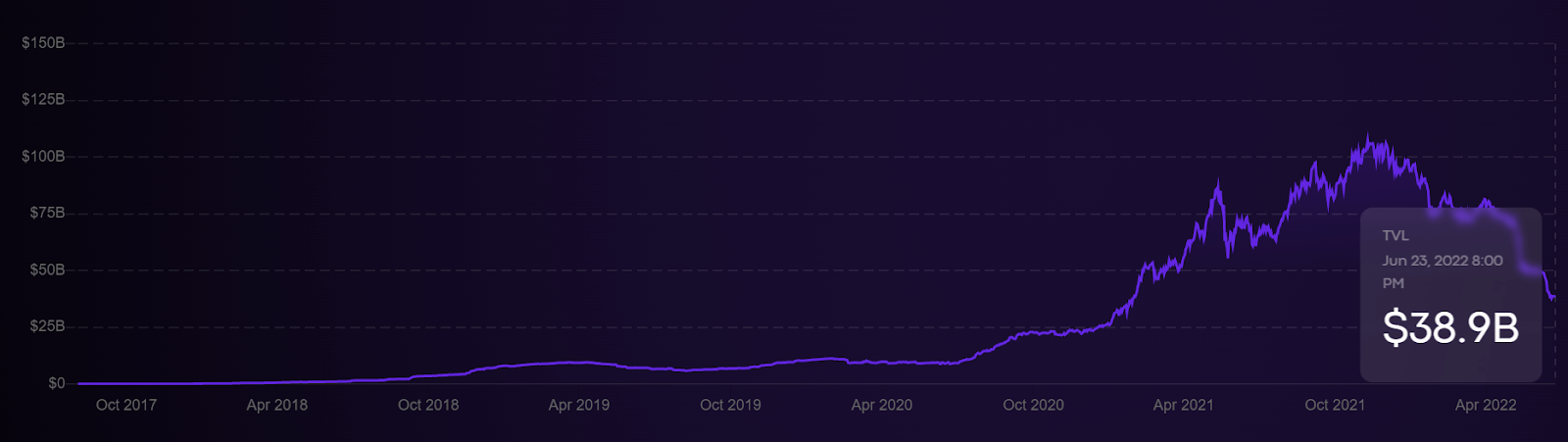

The past May witnessed the most significant cryptocurrency market wipeout in recorded history, with total value locked (TVL) plummeting to levels not seen since early 2021. Prior to its collapse, Terra (LUNA) had emerged as a formidable competitor to Ethereum, capturing 13% of the DeFi market cap—surpassing both Solana and Cardano combined. Ironically, traditional monetary policy from central banking institutions ultimately ignited this crisis.

The Federal Reserve's interest rate hikes triggered widespread market selloffs, pushing DeFi platforms into bearish territory. This downturn directly impacted LUNA's price, which was serving as collateral for Terra's UST algorithmic stablecoin. When the peg broke, over $40 billion in value, alongside Terra's high-yield staking platform Anchor Protocol, evaporated almost overnight.

This catastrophic event sent tremors throughout the entire cryptocurrency space, reaching even Ethereum (ETH), which was already experiencing delays with its highly anticipated merge transition. Market participants with exposure to multiple assets—particularly those engaged in yield farming strategies—found themselves perilously close to insolvency, echoing the fate of financial institutions during the 2008 crisis.

As demonstrated by these events, once a chain reaction begins in the crypto ecosystem, it can create a dangerous death spiral. In response, each affected platform has scrambled to forge bailout arrangements. Voyager Digital secured a $500 million credit line from Alameda Ventures to meet customer liquidity obligations, while BlockFi obtained a $250 million revolving line of credit from the FTX exchange. In a more dramatic development, Goldman Sachs reportedly plans to raise $2 billion to acquire Celsius Network.

These bailout strategies reveal two critical conclusions about the current state of cryptocurrency markets:

However, as contagion continues amid persistent market volatility, a fundamental question emerges: should government authorities intervene in cryptocurrency markets? Such involvement would fundamentally contradict the core principles of cryptocurrencies, which emphasize decentralization and financial sovereignty.

Surprisingly, even traditional financial institutions recognize the importance of cryptocurrency market stabilization. IMF President and World Economic Forum contributor Kristalina Georgieva emphasized at a Davos Agenda meeting that it would be detrimental if the crypto ecosystem were to fail entirely.

This sentiment was echoed by U.S. Securities and Exchange Commission Commissioner Hester Peirce, who noted that while some crypto platforms may struggle, the overall ecosystem requires careful separation of viable projects from unsuccessful ones. She highlighted that platform failures would not only affect investors but also result in widespread employment layoffs and freezes.

The recent months have indeed seen significant workforce reductions across the cryptocurrency sector: Bitpanda downsized by approximately 270 employees, Coinbase reduced its workforce by 1,180 (18%), Gemini cut 100 positions, and Crypto.com eliminated 260 jobs, among other reductions.

In contrast, some industry leaders are taking proactive steps to support cryptocurrency market recovery. Sam Bankman-Fried, CEO of FTX, has positioned himself as a key stabilizer in the developing crypto space. The crypto billionaire believes that the current challenges are inevitable growing pains exacerbated by traditional monetary policies.

His intervention extends beyond market-induced crises to include security incidents. When hackers drained $100 million from the Japanese Liquid exchange, SBF responded with a $120 million refinancing package, eventually acquiring the platform completely.

It's worth noting that traditional financial institutions have also embraced digital assets. Major stock brokers like Robinhood now offer access to select cryptocurrencies, making it increasingly difficult to find popular investment platforms without some cryptocurrency exposure. The collective commitment from these established entities far outweighs temporary market disruptions.

As we assess the current landscape, questions arise about the future of truly decentralized finance. The reality is that few lending platforms can genuinely claim full decentralization, while only centralized institutions possess the deep liquidity required to withstand severe market stress.

Consequently, market participants are increasingly placing their trust in institutions perceived as "too big to fail," with decentralization becoming an aspirational rather than practical reality. This trend applies equally to major exchanges like FTX and Binance, as well as traditional financial institutions like Goldman Sachs.

The encouraging aspect is that powerful entities—from the World Economic Forum to major cryptocurrency exchanges and large investment banks—collectively support the long-term success of blockchain assets. These bailout and acquisition initiatives undoubtedly validate the underlying technology driving digital assets, though they may represent a step backward in terms of decentralization principles.

Looking ahead, the cryptocurrency industry must strike a delicate balance between necessary market stabilization and preserving the core values that initially made blockchain technology revolutionary. The path forward will likely involve hybrid approaches that incorporate institutional safeguards while maintaining decentralized elements where possible.